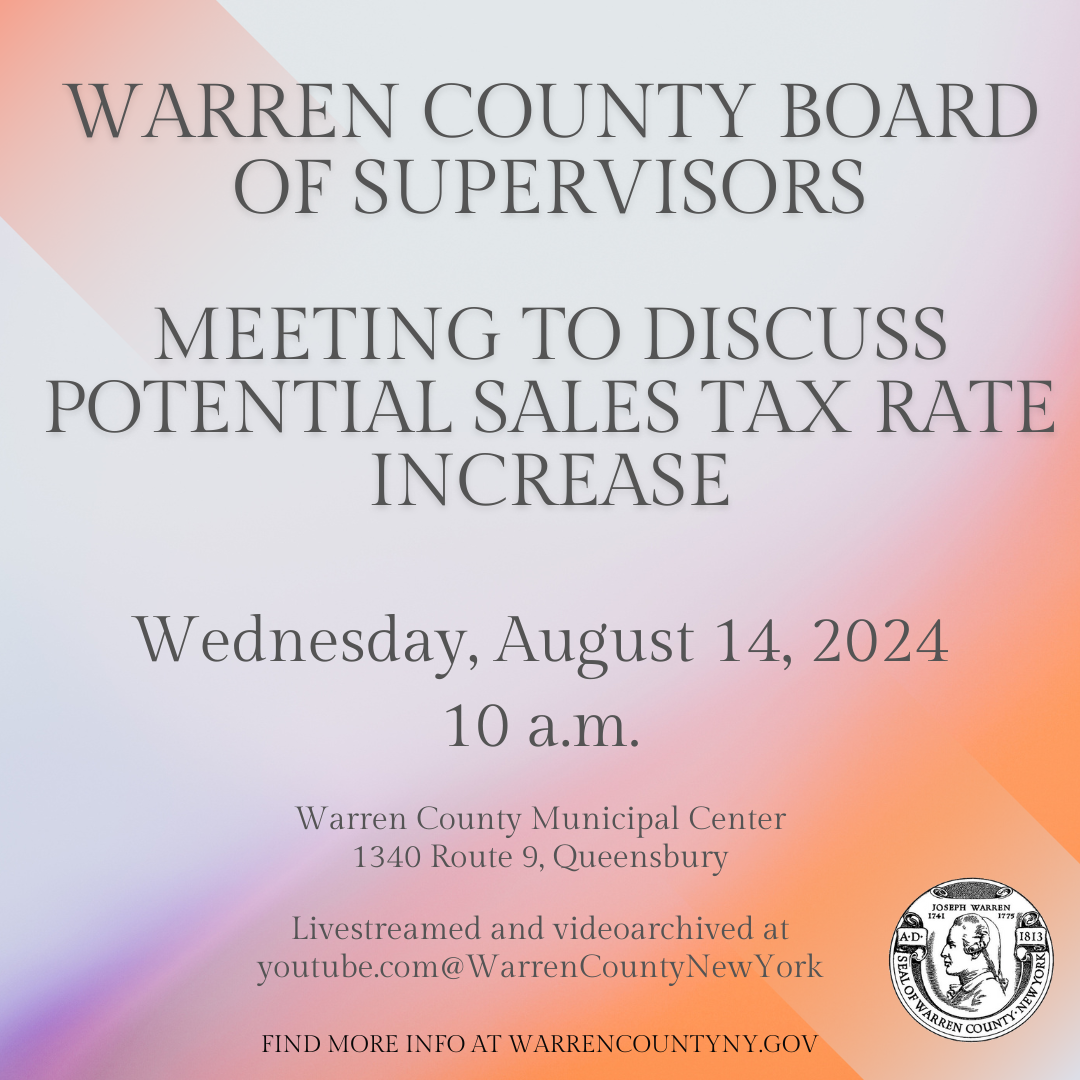

The Warren County Board of Supervisors has scheduled a workshop meeting on Wednesday, August 14 to discuss a proposal to increase the county sales tax rate.

Warren County is one of three counties in New York that currently has a sales tax rate of 7% -- (4% imposed by NY State, 3% by the county) – which, along with two other counties, is the lowest rate in New York State.

The board will discuss a proposal to raise the rate a maximum of 1% (or $.01 on $1 of taxable purchase) to serve as a mechanism to potentially lower the property tax burden and put more of the cost burden on visitors to the county to increase funding for infrastructure repairs and improvements.

Warren County has been hit with unprecedented infrastructure repair costs in recent years because of damage from storms that came at a time of significant cost increases to asphalt, steel, concrete and other materials.

The December 19, 2023 rain storm alone resulted in over $4 million in county highway repairs and $750,000 in repairs to the county-owned rail line, which Warren County is required by federal law to maintain in operational status. The county has also been saddled with millions in costs that were initially unbudgeted for SUNY Adirondack and public transportation in 2024 alone, which will recur going forward.

Said Kevin Geraghty, Chair of the Warren County Board of Supervisors “No one wants to increase taxes, but given the infrastructure issues and increased costs that Warren County faces, we need to weigh the impacts of helping pay for these critical expenses with sales tax or property tax. Our analysis indicates a sales tax increase would enable Warren County to keep property taxes low. We feel a discussion needs to occur at this point in time.”

The Board of Supervisors workshop meeting will be held at Warren County Municipal Center, 1340 Route 9, Queensbury, starting at 10 a.m. on August 14, 2024. It is open to the public, and will also be livestreamed and videoarchived on the Warren County YouTube page here.

The meeting will involve discussion only, as no action can be taken during a workshop meeting. New York State legislative approval would be required if the Warren County Board of Supervisors sought a sales tax rate increase.

###